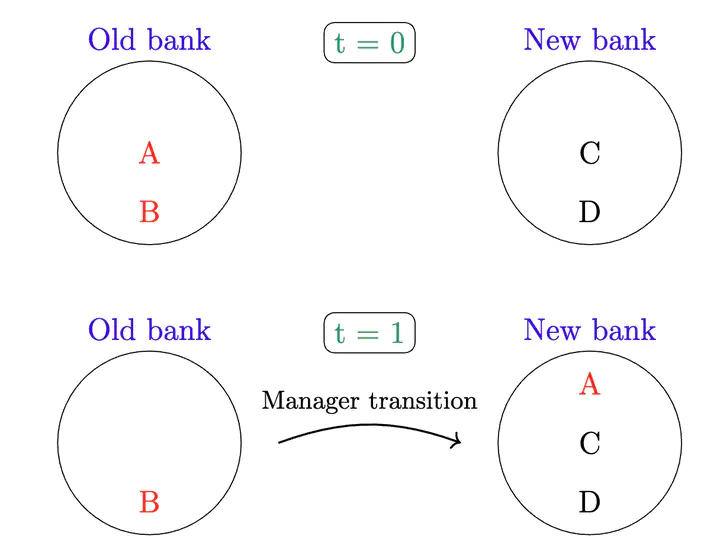

Bank manager moves to a new bank. Firms A and B are part of her portfolio, firm A follows her

Bank manager moves to a new bank. Firms A and B are part of her portfolio, firm A follows herAbstract

Economic theory emphasizes the role of human capital in financial intermediation: bank managers and loan officers accumulate information and build personal relationships that shape credit allocation. Using Italian administrative data, we directly measure these relationships by linking bank managers to their portfolios of client firms and tracking their movements across financial institutions. We show that when a manager switches employers, firms in her prior portfolio become 3.5 times more likely to establish a lending relationship with her new bank. This portability arises because managers lower firms’ switching costs rather than generating adverse selection. We observe a threefold increase in loan applications to the new bank from prior clients but only a modest rise in approval rates. Firms that follow managers pay 0.9 percentage points lower interest rates than on their prior loans but similar rates to other new borrowers at the same bank. Managers transfer valuable information across banks: relationship-originated loans are 4 percentage points less likely to default than other new loans. To isolate the causal role of manager mobility, we exploit variation in the timing of job switches and control for credit demand and supply shocks. In a separate analysis, we also leverage exogenous shocks to mobility induced by branch closures.

Presented at

Capital Theory Seminar, Yiran Fan Memorial Conference, Experimental Seminar Series, Applied Micro Student Seminar, AMT Student Seminar (University of Chicago) • EEA Congress (Bordeaux) • PhD Conference in memory of Denis Gromb (HEC Paris) • EDGE Jamboree (Cambridge) • Department of Finance Seminar, Food 4 Thought, Finance Brown Bag (Bocconi University) • Milan PhD workshop (Bicocca University) • Finest Autumn Workshop (University of Milan) • Labor and Finance Group (Berlin-Halle Iwh)